South Dakota Tax Laws . Taxpayer bill of rights tax. Web south dakota’s sales and use tax rate is 4.5 percent. Web south dakota state tax: The state also has several special taxes and local jurisdiction. Web find sales and use tax information for south dakota: Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. The combined state and local sales tax rate is fairly low when compared to other states. South dakota has no income tax. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web south dakota’s economic nexus laws.

from www.signnow.com

South dakota has no income tax. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web south dakota’s economic nexus laws. The state also has several special taxes and local jurisdiction. Web south dakota’s sales and use tax rate is 4.5 percent. Web south dakota state tax: Taxpayer bill of rights tax. The combined state and local sales tax rate is fairly low when compared to other states. Web find sales and use tax information for south dakota:

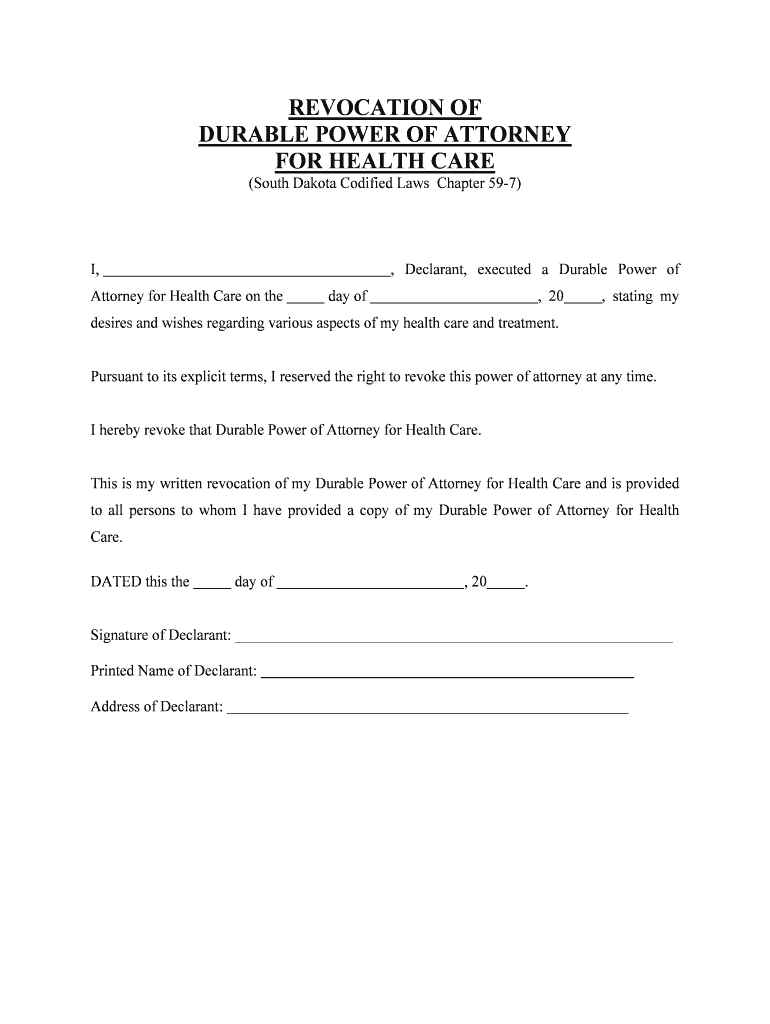

South Dakota Codified Laws Chapter 59 7 Form Fill Out and Sign

South Dakota Tax Laws Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). The combined state and local sales tax rate is fairly low when compared to other states. The state also has several special taxes and local jurisdiction. Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Web south dakota state tax: Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. Web south dakota’s economic nexus laws. South dakota has no income tax. Web south dakota’s sales and use tax rate is 4.5 percent. Taxpayer bill of rights tax. Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web find sales and use tax information for south dakota:

From onprobatelaw.com

What is the gift tax in South Dakota? On Probate Law South Dakota Tax Laws Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web find sales and use tax information for south dakota: Web south dakota’s economic nexus laws. Taxpayer bill of rights tax. The combined state and local sales tax rate is fairly low. South Dakota Tax Laws.

From exoyfxrvd.blob.core.windows.net

South Dakota Tax Exempt Organizations at Silva Upchurch blog South Dakota Tax Laws Web south dakota’s sales and use tax rate is 4.5 percent. The state also has several special taxes and local jurisdiction. Web south dakota’s economic nexus laws. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web find sales and use tax information for south dakota: Web laws, regulations, and information. South Dakota Tax Laws.

From cepqupil.blob.core.windows.net

Do You Pay Property Tax In South Dakota at Alejandra Reilly blog South Dakota Tax Laws The state also has several special taxes and local jurisdiction. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web south dakota’s economic nexus laws. The combined state and local sales tax rate is fairly low when compared to other states. Web find sales and use tax information for south dakota:. South Dakota Tax Laws.

From www.youtube.com

How SOUTH DAKOTA Taxes Retirees YouTube South Dakota Tax Laws Web south dakota state tax: South dakota has no income tax. Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web south dakota’s sales and use tax rate is 4.5 percent. Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Web find sales and use tax information for south dakota: The. South Dakota Tax Laws.

From dakotafreepress.com

South Dakota Taxes Remain Regressive, Taxing Lowest 20 More Than South Dakota Tax Laws The combined state and local sales tax rate is fairly low when compared to other states. Web south dakota’s economic nexus laws. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Web south dakota’s. South Dakota Tax Laws.

From bearswire.usatoday.com

What does Supreme Court sales tax ruling mean for South Dakota? South Dakota Tax Laws Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. Web laws, regulations, and information for individuals regarding taxation on sales. South Dakota Tax Laws.

From www.curtmassie.com

Curt Massie for House District 33 Advocate for South Dakota Taxpayers South Dakota Tax Laws Web south dakota’s sales and use tax rate is 4.5 percent. Web find sales and use tax information for south dakota: Sales tax rates, remote seller nexus rules, tax holidays, amnesty. The combined state and local sales tax rate is fairly low when compared to other states. South dakota has no income tax. Taxpayer bill of rights tax. Web find. South Dakota Tax Laws.

From www.formsbank.com

South Dakota Franchise Tax On Financial Institutions printable pdf download South Dakota Tax Laws Web south dakota’s sales and use tax rate is 4.5 percent. Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Sales tax rates, remote seller nexus rules, tax holidays, amnesty.. South Dakota Tax Laws.

From taxedright.com

South Dakota Taxes Taxed Right South Dakota Tax Laws Web south dakota’s sales and use tax rate is 4.5 percent. Web south dakota state tax: Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. The state also has several special. South Dakota Tax Laws.

From kxrb.com

This South Dakota County Has the Highest Property Taxes Statewide South Dakota Tax Laws Web south dakota’s economic nexus laws. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Web south dakota state tax: The state also has several special taxes and local jurisdiction. Web find sales and. South Dakota Tax Laws.

From www.salestaxhandbook.com

What transactions are subject to the sales tax in South Dakota? South Dakota Tax Laws South dakota has no income tax. Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. The state also has several special taxes and local jurisdiction. Web find sales and use tax information for south dakota: Taxpayer bill of rights tax. Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web south. South Dakota Tax Laws.

From exoyfxrvd.blob.core.windows.net

South Dakota Tax Exempt Organizations at Silva Upchurch blog South Dakota Tax Laws Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Web south dakota state tax: Web south dakota’s sales and use tax rate is 4.5 percent. The combined state and local sales tax rate is fairly low when compared to other states. Web south dakota’s economic nexus laws. South dakota has no income. South Dakota Tax Laws.

From leafwell.com

Is Marijuana Legal in South Dakota? South Dakota Tax Laws The combined state and local sales tax rate is fairly low when compared to other states. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. The state also has several. South Dakota Tax Laws.

From golookup.com

South Dakota Tax Law, South Dakota Tax Laws South Dakota Tax Laws Web south dakota’s sales and use tax rate is 4.5 percent. The combined state and local sales tax rate is fairly low when compared to other states. Web find sales and use tax information for south dakota: Taxpayer bill of rights tax. Web south dakota’s economic nexus laws. Web sales and use tax in south dakota is administered by the. South Dakota Tax Laws.

From www.pinterest.com

Chart 3 South Dakota State and Local Tax Burden vs. Major Industry FY South Dakota Tax Laws Web find sales and use tax information for south dakota: Web laws, regulations, and information for individuals regarding taxation on sales and use tax in south dakota. Taxpayer bill of rights tax. Web south dakota’s sales and use tax rate is 4.5 percent. South dakota has no income tax. The state also has several special taxes and local jurisdiction. Web. South Dakota Tax Laws.

From www.argusleader.com

Where do South Dakota tax cuts fit in after 2024 revenue projects were set? South Dakota Tax Laws The combined state and local sales tax rate is fairly low when compared to other states. Web find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. Web south dakota’s sales and use tax rate is 4.5 percent. Sales tax rates, remote seller nexus rules, tax holidays, amnesty. Web sales. South Dakota Tax Laws.

From pa5113.blogspot.com

State and Local Public Finance Taxing Professional Services Beating South Dakota Tax Laws The state also has several special taxes and local jurisdiction. Web south dakota’s economic nexus laws. Taxpayer bill of rights tax. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web find sales and use tax information for south dakota: The combined state and local sales tax rate is fairly low. South Dakota Tax Laws.

From tme.net

South Dakota Tax Laws How They Came to Rival Other Tax Havens South Dakota Tax Laws South dakota has no income tax. Web sales and use tax in south dakota is administered by the south dakota department of revenue (dor). Web south dakota’s sales and use tax rate is 4.5 percent. The combined state and local sales tax rate is fairly low when compared to other states. Web south dakota’s economic nexus laws. Web find sales. South Dakota Tax Laws.